This month I wanted to create a digital budget calendar, actually a worksheet that will be my tracking system for the upcoming months .

I was absolutely excited with the result. This workbook is so helpful!!!

Using this budget calendar for my bills is a great way to see when everything is due in relation to our paychecks. It makes it so easy to budget by paycheck and know what check pays which bills.

The simple way to use a calendar to get organized is to write out each day your bills are due.

Then highlight each paycheck in a different color and then highlight the bills that are paid with that check.

Now the goal is to get ahead of the due dates. So, if you get paid on the 15th and the 30th, the 15th check will pay everything from the 15th-30th. The check on the 30th will pay all the bill the following month from the 1st-15th.

If you have things due on your paydays, you may need to ask to have due dates moved so that it works better for your life.

Once you can visually see the due dates and paychecks. it will help you organize your bills and pay things on time.

Also the best thing about my budget calendar is that I can use it in place of my bank account , and I can have access to my bank balance anytime I want from my mobile device.

Whenever something coming up I go to my worksheet and put in the new transaction .

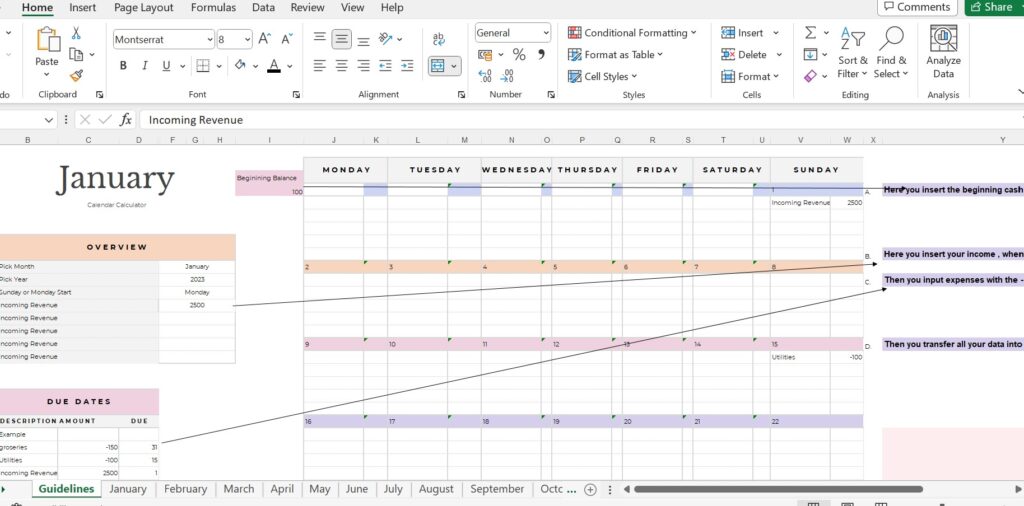

So all I have to do is to input my beginning balance for the month , then put in my income on the dates I receive my paycheck, and then with putting in all my expenses I know exactly how my bank balance will be at the end of the month .

And its huge for knowing our financial situation and our financial picture for the whole month .

This tool is so helpful, so I decided to add it on my 1-1 programs, because I a sure its one more tool to your financial wellness and confidence that all the payments will be covered !!!

It will also make managing your budget easier when everything is paid at the same time each month.

Having trouble thinking of everything to include in your budget? Go back through your past two bank statements and comb through all your spending. Categorize your expenses under categories such as food, gas, beauty, etc. By looking through your previous spending, you’ll be more likely to include all categories in your budget.

Here is a video I walk you through my Budget Calendar.

Below is an example of what your budget calendar might look like

Remember that some of the money you have left for the week will need to be rolled over for the upcoming weeks. It’s okay to have money leftover in your budget. This is a good thing! When you have money leftover, you’ll be more prepared for those upcoming bills and expenses in the future.

So go and create one budget calendar , but also if you want some help?

Visit my store to get started!

https://financialgoalsforwomen.eu/wordpress_6/shop/

Don’t let finances hold you back from the success you deserve.